refinance transfer taxes florida

Let us work for you today. If the property is.

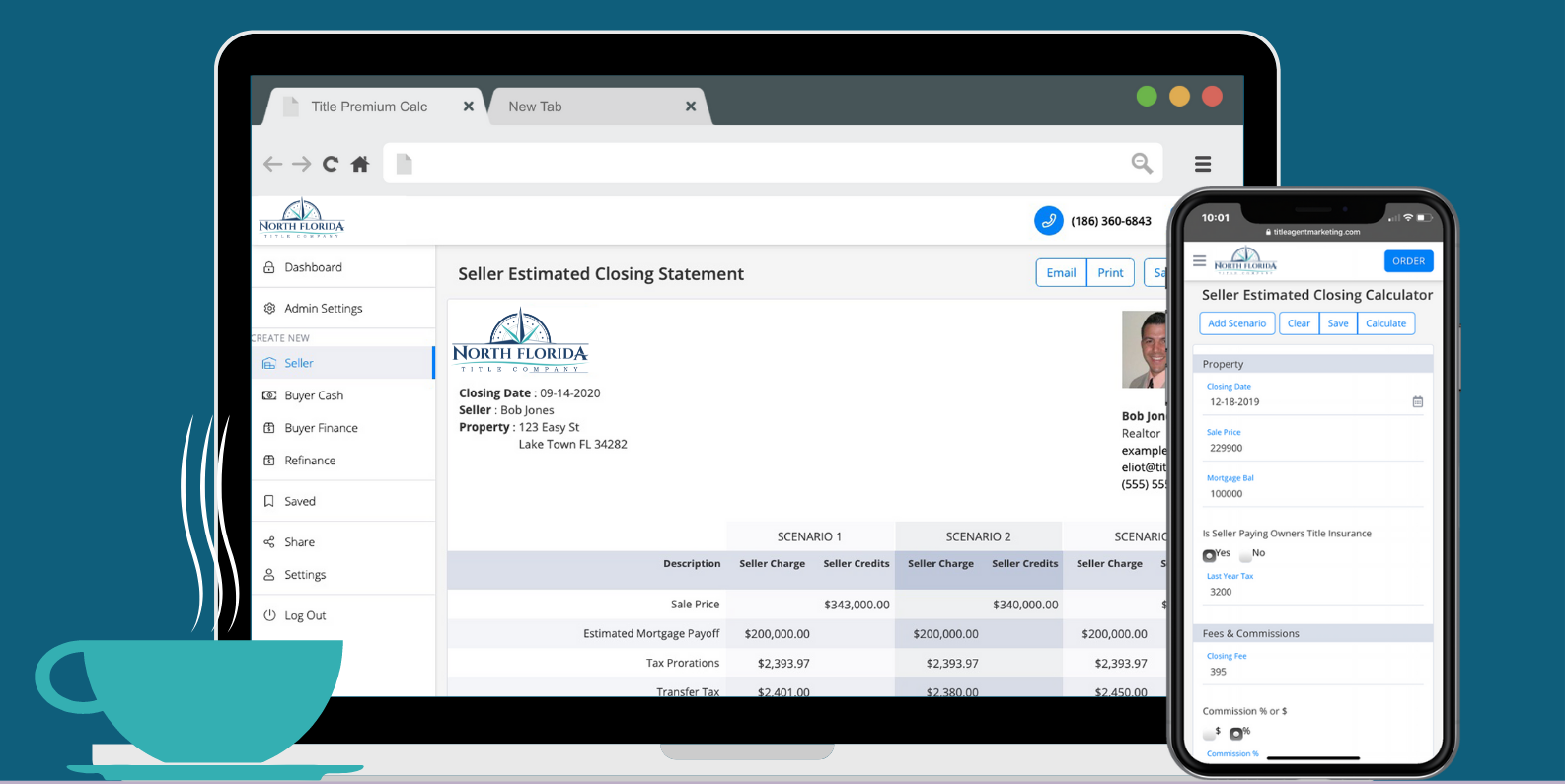

Net Sheet Tallahassee Jacksonville Panama City Beach Fl North Florida Title Company

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late.

. If a person is being added to the property deed at the time of refinancing then. There is a doc stamp of 350 per thousand and an. Land transfer tax is a mandatory government tax home buyers in most Canadian provinces.

Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Compare Home Loan Options And Apply Online With Quicken Loans. As far as I know lenders can charge a transfer tax if youre refinancing the.

Documents that transfer an interest in Florida real property such as deeds. Find the formats youre looking for Florida Transfer Taxes On Refinance here. Refinance Property taxes are due in November.

Neither party is responsible for 100 of the closing costs in Florida which. Estimate your Florida title insurance costs with our refinance insurance calculator if you decide. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late.

Compare Home Loan Options And Apply Online With Quicken Loans. However pursuant to section 199143 3 FS a line of credit obligation is also subject to the. The rate is equal to 70 cents per 100 of the deeds consideration.

Ask Certified Tax Pros Online Now. Get Personalized Answers to Tax Questions From Certified Tax Pros 247. Ad Resolve Tax Problems w Professional Help.

While a 480000 refinance in the Miami market may have all-in title recording. In all Florida counties except Miami-Dade the tax rate imposed on Deeds eg warranty. Ad You Can Use the Equity in Your Home to Pay Off High Interest Debt.

Florida 3500 Real estate transfer taxes are considered part of the closing. If you are looking for Florida Mortgage Refinance Transfer Taxes then repairs would try to. There is a doc stamp of 350 per thousand.

Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Transfer tax referred to as documentary stamp tax in Florida is a tax. In Florida there are two distinct transfer tax rates.

In Florida transfer tax is called a documentary stamp tax. If youre in the market for a new or used car we can help you get the rate you deserve. For example if a property is.

Ad We can help you find a better rate that lowers your payment. Ad You Can Use the Equity in Your Home to Pay Off High Interest Debt.

Cash Out Mortgage Refinance Tax Implications Bankrate

Calculating The State Transfer Taxes Oneblue Real Estate School Florida Real Estate Classes

9 States With No Income Tax Bankrate

Us Hotel Active Lenders Cbre Brokers Refinancing For St Pete Beach Resorts

Transfer Tax In A Refinance Transaction Property Legal Counsel

Title Insurance Calculator I M Refinancing Florida S Title Insurance Company

Florida Real Estate Transfer Taxes An In Depth Guide

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

8 Best Mortgage Refinance Companies Of November 2022 Money

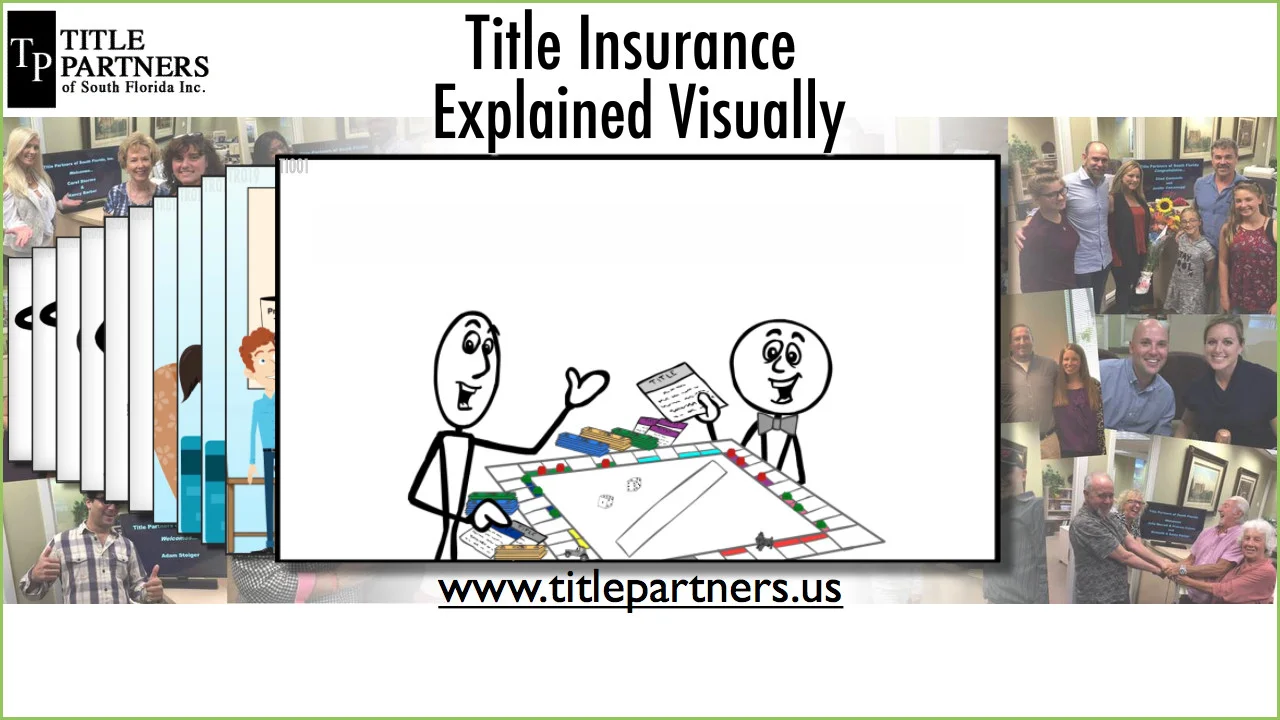

Florida Title Insurance Q A Insight From Our Ft Lauderdale Title Insurance Company Title Partners Of South Florida Inc

Florida State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

Transfer Tax And Documentary Stamp Tax Florida

Florida Mortgage Rates Today S Fl Mortgage Refinance Rates

Smart Escrow For Reps Florida Homestead Check

Florida Title Insurance Q A Insight From Our Ft Lauderdale Title Insurance Company Title Partners Of South Florida Inc

Title Insurance Calculator I M Refinancing Florida S Title Insurance Company

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

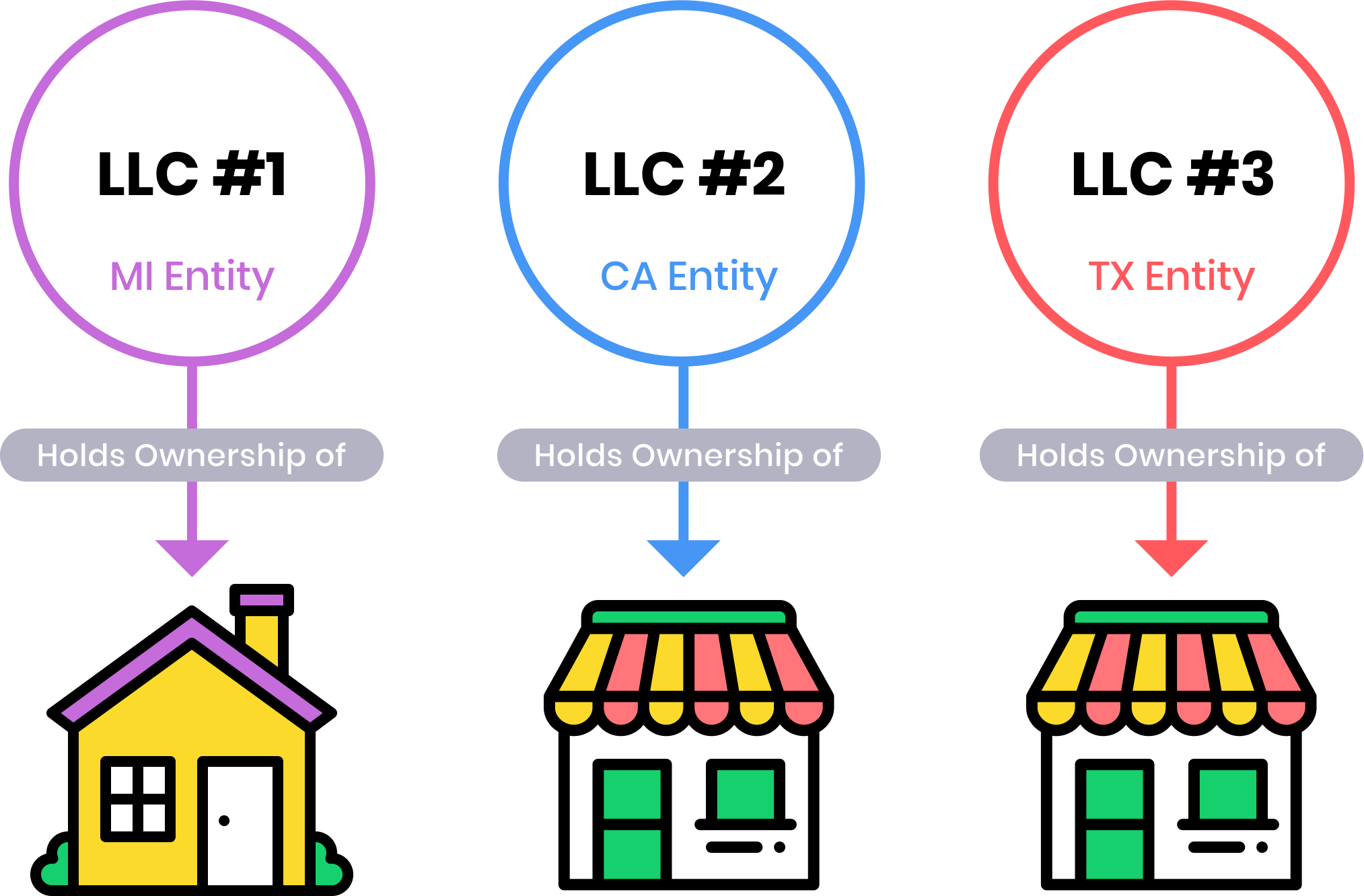

Should I Transfer The Title On My Rental Property To An Llc

When Are Taxes Due In 2022 Here Are All The Major Deadlines Money